Part II of Synergising Foreign Investor and State Climate Priorities.

- CGM

- Dec 10, 2025

- 3 min read

Updated: Jan 16

"Legal Levers for Green Investment in ASEAN: What Works, What Does Not and the Way Forward"

Date: 6 November 2025

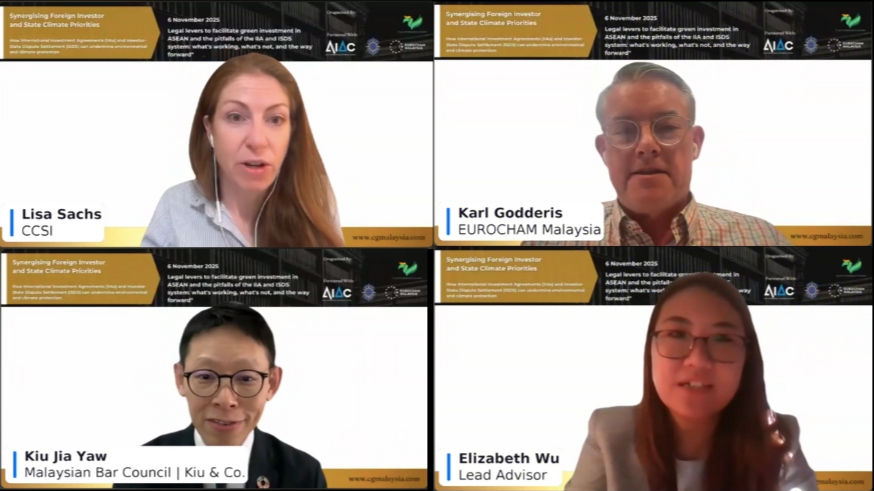

Speakers:

Lisa Sachs, Director, Columbia Center on Sustainable Investment

Karl Godderis, CEO, EuroCham Malaysia

Kiu Jia Yaw, Chair of the Bar Council Environment & Climate Change Committee | Sustainable Development Lawyer, Kiu & Co

Moderator:

Elizabeth Wu, Lead Advisor, Environmental Justice and Transnational Governance, Climate Governance Malaysia

The session “Legal Levers for Green Investment in ASEAN: What Works, What Does Not and the Way Forward” examines whether current international investment agreements (IIAs) and investor-state dispute settlement (ISDS) actually support the green and just transition, and argues that they largely fail to do so while imposing high costs and regulatory constraints. The discussion then pivots to what states, particularly in ASEAN, should do instead: terminate legacy treaties, curb investor-state arbitration, and focus on domestic and regional governance tools - such as clear energy-market rules, grid planning, and sector-specific regulation - to attract and align sustainable investment, including in emerging areas like data centres.

Moderator Elizabeth Wu frames the webinar as part of a Malaysian Bar-CGM-AIAC series on aligning investment law with climate and just transition goals, introducing panellists Lisa Sachs (Columbia Center on Sustainable Investment), Karl Godderis (CEO of EuroCham Malaysia), and Kiu Jia Yaw (Malaysian Bar Council | Kiu & Co.). Kiu links the discussion to Malaysia’s rule-of-law commitments, recent ASEAN declarations on the right to a clean, healthy and sustainable environment and the right to development, and Malaysia’s new National Action Plan on Business and Human Rights, stressing the need to reconcile 20th‑century investment treaties with planetary boundaries and human rights.

Lisa Sachs explains that decades of empirical research, including a meta‑study of 74 econometric analyses, find that investment treaties have, at best, a negligible effect on foreign direct investment flows - effectively close to zero- especially when weighed against their costs. She underscores that what matters for investors are economic fundamentals and regulatory quality, while treaties mainly shape how investments are structured (treaty shopping for protections) rather than whether they occur.

Karl Godderis confirms from business experience that ISDS is essentially absent from European companies’ investment decisions in Malaysia: EuroCham’s detailed FTA survey drew strong demands for regulatory predictability but no mention of ISDS. He notes that EU trade negotiations in the region (with Singapore, Indonesia, Malaysia) now routinely carve out or delay the investment-protection component, yet companies still focus on practical regulatory conditions and ease of doing business rather than arbitration rights.

Sachs stresses that ISDS entails mounting societal costs: large and growing claims (often in the hundreds of millions or billions), heavy defence expenses, and “regulatory chill” when governments delay, dilute, or abandon public-interest measures for fear of being sued. She points out that most ISDS cases continue to be brought under pre‑2010 treaties, and investors routinely treaty‑shop into these old‑style agreements even when newer treaties exist, meaning that cosmetic reforms to recent models do little to change outcomes.

So‑called “new generation” or “green” IIAs with procedural tweaks and high‑level corporate responsibilities are, in her assessment, mostly tinkering: they do not alter the basic asymmetry, the breadth of investor rights, or the size and threat of claims. She cites scholarship describing this pattern as “new treaties, old outcomes” and endorses a UN Special Rapporteur’s characterization of such reforms as “putting lipstick on a pig,” because they leave the core power imbalance and chilling effects intact.

Click here to watch the recording

.png)

Comments