We Can Halve Embodied Carbon

- Anjali Viswamohanan

- Jul 21, 2021

- 9 min read

Contributed by volunteer Anjali Vishwamohanan

The recording of past Roundtable sessions are available on this CGM YouTube playlist.

If you have any recommendations we should consider, do submit them to us online via this Google Form.

Property & Construction Sector Roundtables: Can Malaysia Achieve Net Zero Carbon by 2050?

Roundtable 1: Strategies to reduce embodied carbon in the built environment

On 12 July 2021, CGM and CEO Action Network kicked off the first of the Property & Construction Sector Roundtable engagements on net zero pathways for Malaysia. Almost 300 people registered for this first roundtable session for the sector which focused on strategies to reduce embodied carbon in the built environment.

The session was moderated by Mr. Gregers Reimann of GreenRE and EUROCHAM Malaysia. The panellists for the session included:

1. Darshan Joshi, Institute of Strategic and International Studies, Malaysia

2. Ts. Dr. Foo Chee Hung, MKH Berhad

3. Yasotha Chetty, OHR Engineering

4. Ir. M. Ramuseren, General Manager, CIDB Malaysia

38% of total global CO2 emissions comes from the building and construction sector. Of this, 28% is operational carbon while 10% is embodied carbon. Embodied carbon is associated with the emission caused by extraction, manufacture, transportation, assembly, maintenance, replacement, deconstruction, disposal and end of life aspects of the materials and systems that make up a building. On the other hand, operational carbon is associated with operations (heating, cooling, powering, providing water, etc.)

Ir. Ramuseren of CIDB Malaysia highlighted that total emissions for the construction industry is 76 MtCO2 equivalent. If no action is taken to control emissions from the sector, there will be a 92% increase in emissions by 2050. In order to develop emission control strategies for the sector, the Malaysian government will require base level data on emissions. Tax incentives could be provided to companies to encourage greenhouse gases (GHG) reporting, which would be used by policymakers in developing a comprehensive emission control plan. Once these structures are in place, a carbon tax structure could be implemented to disincentivise excessive GHG emissions.

Darshan Joshi of ISIS elaborated on what a carbon tax structure could look like for Malaysia. In addition to reducing GHG emissions, carbon tax would also result in an increase in government revenue which can be used for activities such as climate finance, investments for public transport, alleviation of fiscal burden, carbon rebates for poor households, etc. The potential rate for carbon should be set based on factors such as actual social cost of carbon, political feasibility and economic factors.

Yasotha Chetty of OHR Engineering advocated for a change in building design and structural materials used in construction to reduce embodied carbon in the construction sector. Leaner building design would require lesser material, resulting in lesser embodied carbon. One could also consider optimising design by cement replacement. Optimal design with 40% cement replacement (with lower carbon embodied material and no additional cost) would lead to a 48% reduction in embodied carbon. Timber with lower embodied carbon is dubbed to be structural material of the twenty-first century and has been used in construction globally. However, Malaysia’s UBBL does not allow the use of timber as a structural material at the moment.

The session also benefitted from Yasotha’s insights on why the construction industry in Malaysia has not implemented these recommendations so far. Firstly, there is a clear dearth of policy incentives. Secondly, there are cost factors such as high consultation fees for engineers to design and approve a lean building design and higher costs of materials that can be used to replace cement in construction. Thirdly, a shift in mindset and better understanding of these low carbon options is required.

Ts. Dr. Foo Chee Hung of MKH Berhad pointed out the current deficiencies in the implementation of the Industrialised Building System (IBS) in Malaysia. He recommended that to get the sector to try and align with the Government’s initiative to drive IBS score to above 70, the government should provide tax deductions and non-monetary incentives such as an increase in density and plot ratio or reduction in development charges.

The discussants for the session agreed that the policy focus in Malaysia has been more on reducing operational carbon than prioritising embodied carbon. As such, there are a number of regulatory hurdles in implementing some of the recommendations that have been highlighted in the session.

Further, all panellists agreed that the government will have to adopt a carrot and stick approach in getting the construction sector to transition to a low carbon future.

Feedback from the Audience

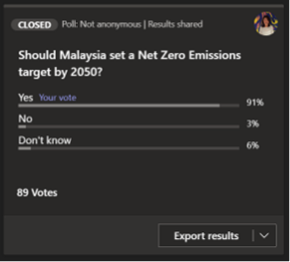

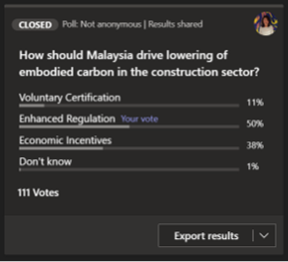

A short poll conducted the start of the session showed an overwhelming majority felt that Malaysia should set a net zero emissions target by 2050 while a clear majority felt that enhanced regulations would be sufficient to drive lower embodied carbon levels in the construction sector.

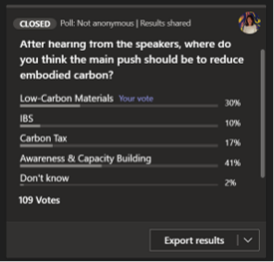

Meanwhile, the poll conducted at the end of the session saw 87% supporting a carbon tax while 41% felt that more awareness and capacity building was needed to reduce embodied carbon, followed by 30% advocating low-carbon materials.

Responses to Questions raised

1. Is there an accessible database for GHG emission from construction process in Malaysia as presented? And the detail breakdown of GHG emission from different construction products?

Ir Ramu (CIDB): There is a database for GHG emissions for construction industry/process (manufacturing, transportation and construction ) in Malaysia, contact SHEQ Division at CIDB for further details.

2. If a carbon tax is incrementally introduced, it seems sensible that some of it can be used for incentives, can the panel comment on this please.

Ir Ramu (CIDB): Agreed. Carbon Tax should go along with other incentives. Cap and Trade System should be introduced as presented. The government to set the limits on GHG emissions for industries and companies. Industries & companies that successfully reduce GHG emissions can sell the remaining limits to other companies.

3. Where can we get more information about the incentive scheme by Malaysian Government on low carbon construction material initiative? Thank you.

Ir Ramu (CIDB): Most of the green incentives come from Malaysian Green Technology & Climate Change Centre(MGTCCC). CIDB is also giving a 100% subsidy for MyCREST and Sustainable INFRASTAR assessments for both building and infrastructure projects (2021), contact CREAM or SHEQ Division at CIDB for further details.

4. Which Scope 1, 2 or 3 should capture landuse change activities, prior to construction? specifically tree removal for example.

Yasotha (OHR): For structural timber to positively affect climate change, it should be sustainably sourced (from a managed forest and accredited).

5. Which concrete has more than 40% cement replacement?

Yasotha (OHR): It is not a specific type of concrete or a proprietary blend. The consulting engineers has to note in their reinforced concrete specification for the percentage of replacement required, the governing code (BS8500) and any other compliance requirements

6. Is timber adequate to support construction? Can this effect climate change?

Yasotha (OHR): Structural timber (i.e., timber fabricated for use as structural material) is becoming a common and preferred material globally for its environmental benefits. The current tallest timber building is 18 storeys high, and concrete-timber or steel-timber hybrid systems could be used to construct taller buildings.

For timber to positively affect climate change, it has to be sustainably sourced. There are globally recognised certification schemes such as FSC and PEFC that tells if a timber has been sustainably sourced.

7. Increasing usage of timber structures – would this again impact the environment? How can this be considered (perhaps justified) in construction?

Yasotha (OHR): For timber to positively affect climate change, it has to be sustainably sourced. There are globally recognised certification schemes such as FSC and PEFC that tells if a timber has been sustainably sourced.

Sustainably sourced timber come from managed forests that ensures continued regeneration.

8. In term of reporting, should operational carbon and embodied carbon be reported separately or it is a summation equation that both sum up to a total CO2e emission? Operational carbon is in the timebound (tCO2/yr) and embodied carbon normally we consider a one-time emission with time bound.

Ir Ramu (CIDB): The whole carbon footprint for a project shall include both embodied and operational carbon.

9. How do you convince authorities UBBL etc to change by-laws involving timber for commercial usage? How about greener options such as bamboo which is abundant in Malaysia?

Yasotha (OHR): To convince authorities: It has to become a national agenda with directives from the government to the statutory stakeholder to make it happen (which is what Singapore did)

Use of bamboo: Timber as a structural material is more established and proven than bamboo and has (for a long time) a full suite of codes of practice to enable its use. Bamboo is slowly catching up with timber. A design code of practice was only recently published, which might speed up its use. For Malaysia, however, the key and significant step towards using other alternative natural structural materials would be first to start using structural timber.

10. How to encourage more IBS producers in Malaysia?

Ir Ramu (CIDB): We need new Regulation in regards on the use of IBS. Awareness and incentives already there since the introduction of IBS Roadmap since 2003. Time to introduce new Law in regards to the use of IBS in Malaysia to reduce construction waste, fuel consumption, improve workmanship quality, reduce workforce and improve productivity.

Dr Foo (MKH): Throughout these years, there is no lack of incentives given to manufacturers with the aim of increasing the supply of IBS components. This is evident in the Budget 2021, where tax incentives given to manufacturers of IBS components was extended. Companies that produce at least three basic components of IBS or IBS systems that use at least three basic IBS components are eligible for the incentive tax allowance of 60% on qualifying capital expenditure incurred within five years, which can be set of against 70% of statutory income for each year of assessment. The logic behind this incentive is that, by encouraging more IBS manufactures and suppliers in the market, cost of IBS components will be reduced, thereby leading to competitive pricing compared conventional construction.

However, incentivizing the supply side alone is not enough. With the lack of demand from the developers and contractors in using IBS construction, IBS manufacturers cannot optimize their production capacity, and therefore cost of IBS components is still higher than conventional construction. As such, a paradigm shift in giving incentive is needed, where the developers need to be incentivized in order to generate more demand for using IBS.

11. In terms of carbon offset calculations, If we deduct the embodied carbon from the production of the renewable energy, e.g. solar panels, do we still have a positive result because most of the time we only calculate the renewable energy generated but forget about the manufacturing process of it?

Ir Ramu (CIDB): Calculating carbon offset shall include the embodied carbon for the solar panel as well. Usually, the positive results will be achieved after the use of these solar panel during operation and maintenance period. The positive results from renewable energy from solar panel is the result of renewable energy minus embodied carbon from the solar panel.

12. If carbon taxes are bought in eventually, and if the carbon emissions reduction from IBS can be determined, this may provide some incentive to increase IBS level adoption. it seems some verification of carbon reduction would be needed.

Dr Foo (MKH): Yes, you are right. However, most importantly, we have to ensure that the incentives are directly channeled to the developers because developers are currently using “hybrid” construction for high-rise development, where certain IBS components are used congruently with the cast on-site conventional construction system. Most of the time, this combination of construction methods can generate an IBS score of 50 to 60, and most importantly this results in cost optimization. So, what is the point of getting higher IBS score, let say > 70 which would definitely result in a higher cost? Only by giving incentives to developers, will they be encouraged to use more IBS components in their construction.

13. Panel speakers have some good recommendations to reduce the carbon emissions and I'd like to know how these recommendations will be forwarded and considered by relevant authorities for further study and perhaps to implement it?

Ir Ramu (CIDB): Study on GHG Emissions by CIDB will be presented to MyCAC for consideration. This study has made some recommendations on incentives and disincentives for carbon reduction in construction industry as presented.

14. I would like to know if the embodied carbon data / conversion as per MyCrest is embedded on BIM platform?

Dr Foo (MKH): MYCREST has its own carbon calculator, in the form of excel sheet, which is not embedded on BIM platform.

15. How do you balance and convince the developers on the debate of the cement replacement vs the strength and curing time which eventually affects the construction period?

Ir Ramu (CIDB): The adoption of green cement does not compromise the strength, curing or durability of concrete. If the green cement complies with these requirements, the other factor to consider is the cost of the green cement. The cost has to be either same as OPC or lower.

16. Do we have the guidelines on GHG limit for the building & construction industry in place now, particularly on embodied carbon?

Ir Ramu (CIDB): At the moment we do not have this requirement yet, unfortunately. Government to consider to introduce this requirement immediately by asking the manufacturers report on GHG emissions for construction materials and the Government to provide incentives for these reporting. By having these reports, the Government will be able to formulate policies or regulations to limit GHG emissions for construction materials. This is one of the recommendations in the GHG Emissions study carried out by CIDB Malaysia for the construction Industry.

17. Could Malaysia lead the way in the region with engineered timber / glulam?

Yasotha (OHR): Yes if we could implement the policy recommendations I outlined in the presentation. It has to become a national agenda with directives from the government to the statutory stakeholder to make it happen

Presentation Decks by:

1. Darshan Joshi, Institute of Strategic and International Studies, Malaysia

2. Ts. Dr. Foo Chee Hung, MKH Berhad

3. Yasotha Chetty, OHR Engineering

4. Ir. M. Ramuseren, General Manager, CIDB Malaysia

.png)

Comments